The recent speculative excess in Shiba Inu, which made some worry about the health of the market in general, seems to be cooling, as seen on Coinbase’s volume breakdown for the previous week.

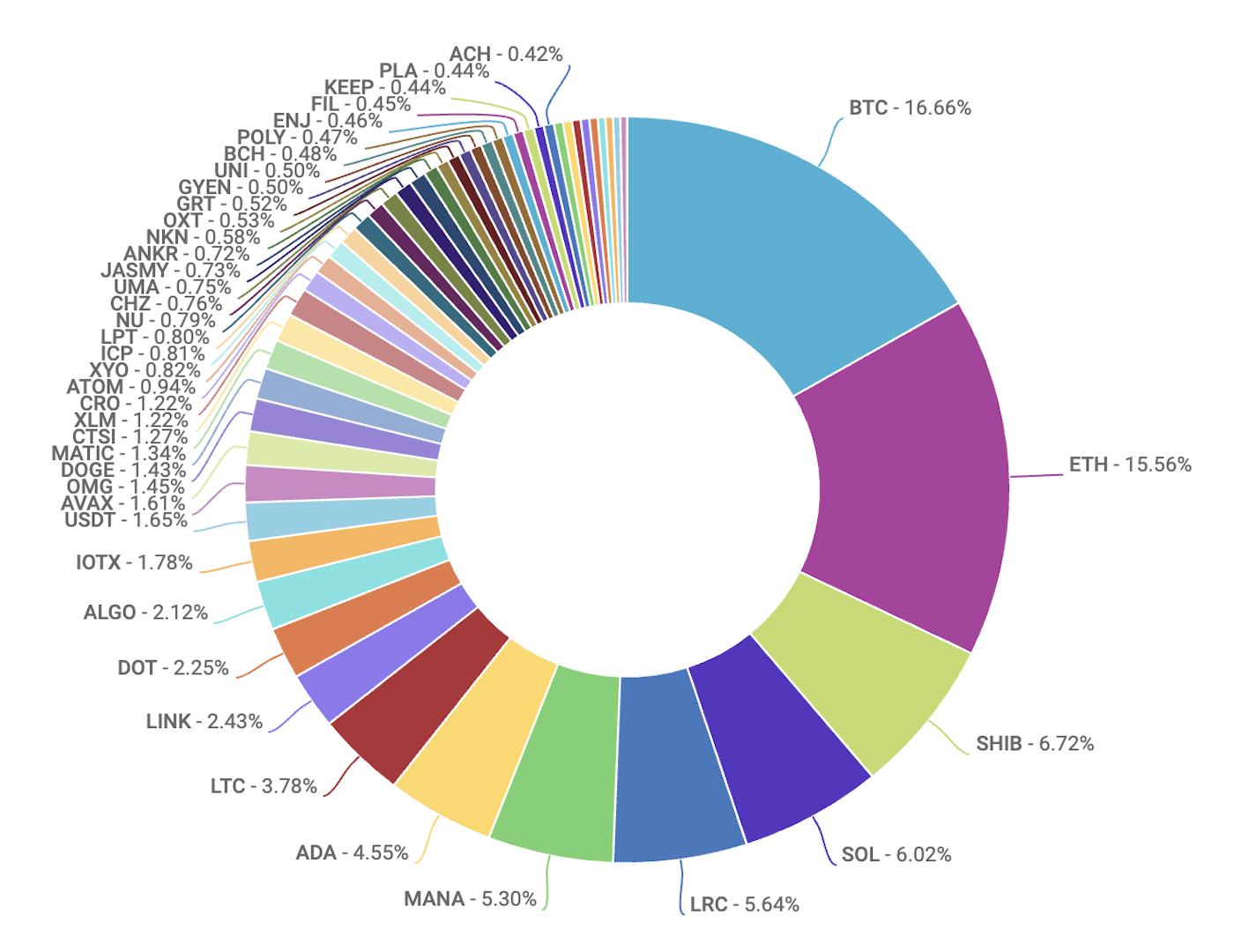

SHIB represented 6.72% of the total turnover on Coinbase, falling to the third position, with Bitcoin and Ether returning to the number one and two positions.

The so-called DOGE killer topped volume rankings on Coinbase for the previous two weeks, registering 16.6% to total activity in the seven days to November 11th and 25% in the seven days to November 5th.

A weekly newsletter from Coinbase revealed that: “In terms of the volume breakdown, BTC and ETC have reclaimed the top spots while SHIB is still in the third place for now as the retail meme coin mania cools off.”

Nevertheless, SHIB remains ahead of other well-known cryptos, like SOL, DOT, MATIC, or LINK.

The retail-dominated token has been in the top three most traded coins since the second week of October.

SHIB recorded a strong bid in the second half of the previous month after BTC went to establish a new ATH, surpassing the levels seen in April when it topped $64,889. On October 28th, SHIB was trading for $0.00008894, ending the month with an impressive gain of 830%.

Several analysts saw this increase as a sign of retail frenzy that is often noticed at broader market tops. The parabolic run recorded by SHIB in early May was followed by a market-wide sell-off when BTC fell from $58,000 to $30,000 in only a week.

As such, history seems to have repeated itself over the past weeks, as BTC fell to a five-week low of $55,666 on November 19th and has failed more than once to create a foothold above the April high of $64,889 since mid-October.

As the speculative madness is taking a step back, market attention may return to Bitcoin and other big cryptos.

At press time, SHIB was trading for $0.00004530, which indicates a monthly loss of 32%. Meanwhile, BTC was traded for $59,420, just a 3% down for the month.