It has been confirmed that Morgan Stanley has increased its Bitcoin exposure to more than $300 million by acquiring more shares of the Grayscale Bitcoin Trust for three of its managed funds in Q3.

This was revealed as part of its most recent US SEC filing where the Morgan Stanley Institutional Fund’s Growth Portfolio declared that it holds 3,642,118 shares of GBTC as of the end of Q3. At the end of Q2, it held 2,130,153 which represents an increase of 71% to Q3.

The Grayscale Bitcoin Trust represents a financial vehicle that lets investors trade shares in trusts that hold large pools of BTC. Thus, investors can enjoy exposure to Bitcoin without having to actually buy or hold it.

The company bought GBTC in Q3 via the Morgan Stanley Insight Fund (CPODX). It increased its holdings to 1,520,549 GBTC, which is an increase of 63%, as it owned 928,051 shares in Q2.

Furthermore, the Morgan Stanley Global Opportunity Portfolio grew its GBTC holdings to 1,463,714 shares from 919,805. This was an increase of 59% for Q3.

In total, the GBTC shares available in the three funds have reached 6,626,381, or about $307 million. Currently, the price of GBTC is trading hands for $46.42.

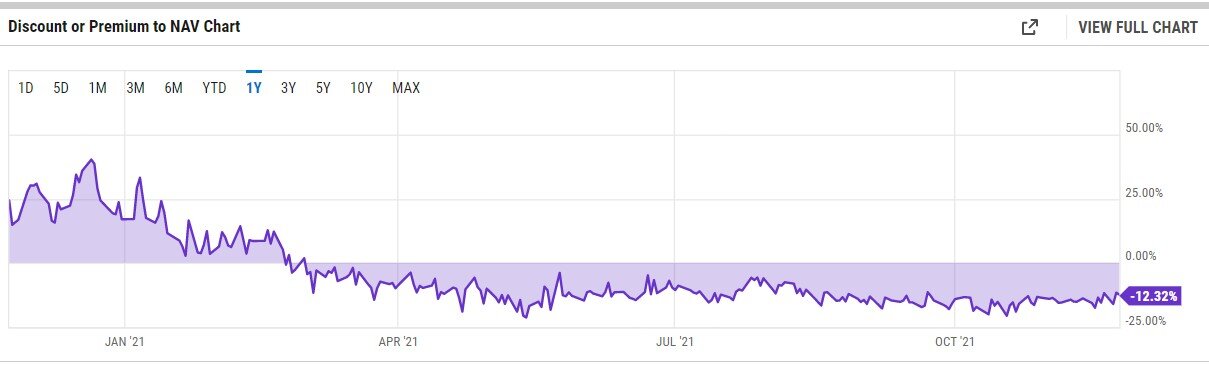

GBTC has been trading at a lower price since February. This means that the price of the shares is lower compared to the actual current value of the coin they represent. Info from YCharts shows that the price has a discount of -12.32%.

By October 29th, Bitcoin’s value grew by 95% since 2021 began, but one of the industry’s largest BTC-focused funds had a return rate of just above 42% for the same time period.

The parent company of Grayscale, Digital Currency Group, stated in October that it could repurchase some GBTC shares following the upping of the purchase authorization to $1 billion from $750 million.

This may solve the discount issue for the moment since it would make the discount between the market price of GBTC shares and their net asset value (NAV) have a smaller gap.

But, in the long run, Grayscale is looking into changing its flagship product into a Bitcoin ETF. In fact, a formal application was already sent in October to the US SEC, but, as we know, the waiting period can be rather long.

Source: Decrypt.co